Sunday Drive - 06/19/2022 Edition

👋🏻 Hello friends,

Greetings from Saratoga Springs!

Today marks the first Father's Day after losing my dad earlier this year, and the second Father's Day without my father-in-law, with whom I was very close. It's all part of the cycle of life, I suppose, but that doesn't make it easy. So, to all the fathers out there who are reading this, I wish you a very happy Father's Day. I certainly plan to savor this year's holiday with my own younglings.

Enjoy this week's leisurely Sunday Drive around the internet.

Vibin'

The vibe of the week is What a Fool Believes by the Doobie Brothers from 1979. I'd apologize for repeating a Doobie Brothers song after only a couple of weeks, but I will NEVER apologize for vibin' to the Doobies. 😎

For our families, our clients, our friends, for ourselves, we are all struggling with how to navigate our way through an economic and investing environment that hasn't existed since most of us (my older readers) were children. For my younger readers, never in your lifetimes. Even so, the historical parallels to the 1970's aren't perfect, and there is no template to work from, so we do our best to muddle through.

I heard this song the other night while out to dinner, and as I listened to the chorus, I thought to myself, "Man, if this doesn't capture the current market environment, I don't know what would!"

What a fool believes he sees

No wise man has the power to reason away

What seems to be is always better than nothing

Quote of the Week

"If we operate from a belief in long sweeps of time, we build cathedrals. If we operate from fiscal quarter to fiscal quarter, we build ugly shopping malls." - Lynda Gratton

Chart of the Week

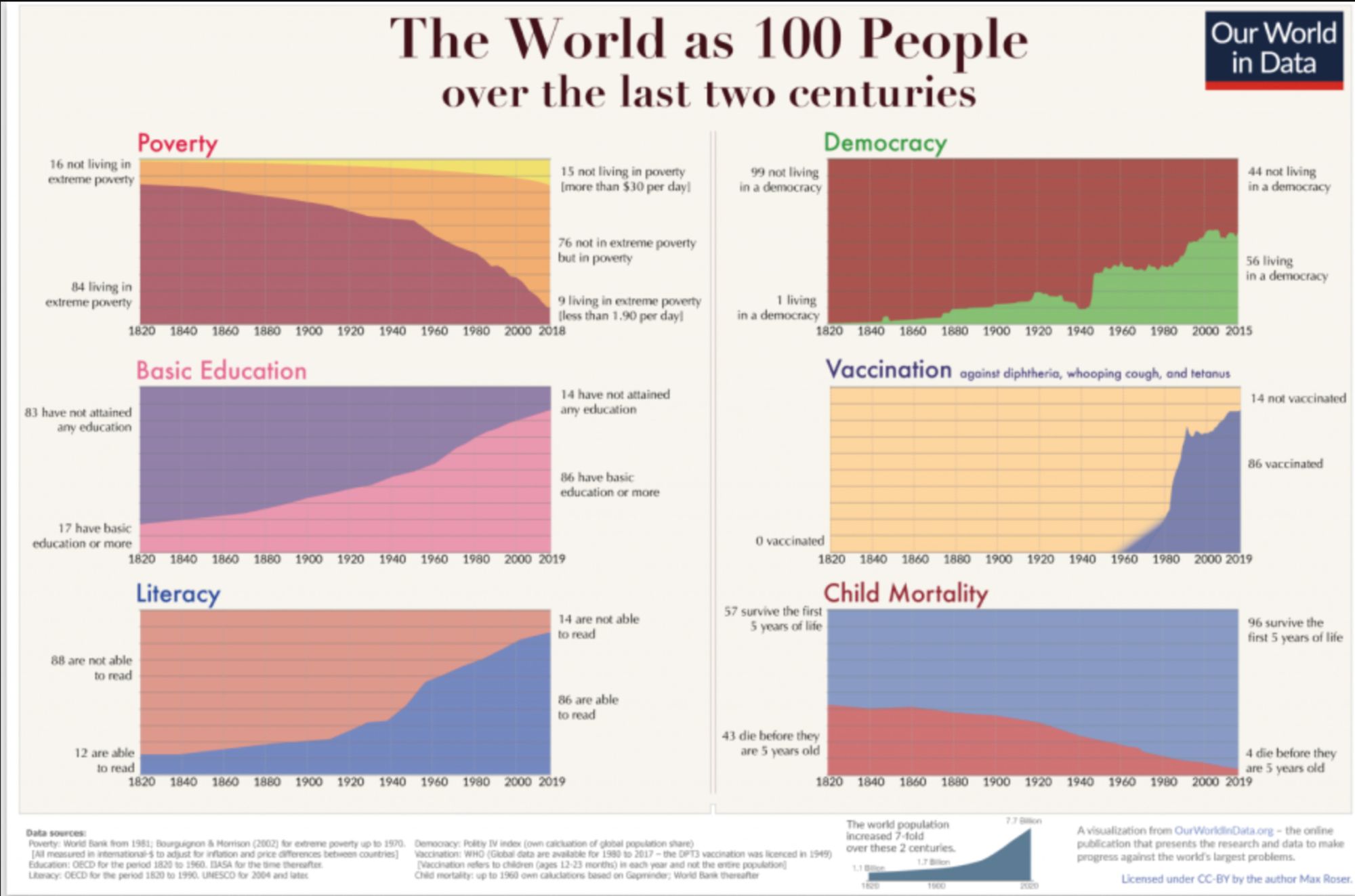

Here's an exercise in showing absolute progress, not progress relative to a growing population. If the world had only 100 people over the last two centuries, this graph shows the progress we've made in terms of poverty, basic education, literacy, democracy, vaccination, and child mortality.

Never bet against human ingenuity - the human enterprise - and our collective ability to progress beyond the current troubled times.

Interesting Drive-By's

💡 The Case for American Seriousness - Compelling piece by Katherine Boyle. We don't need aging institutions to pave the way for 21st-century dynamism. What we need is will. And audacity.

📈 How curing aging could help progress - Three reasons.

- Population - Arresting the demographically driven global population decline which is now accelerating.

- Burden of knowledge - Individual researchers would have longer to contribute to advancements.

- Long term thinking - How would people's thinking change if they felt they'd be around for 150 years? 300 years or even longer?

🤔 On not retiring - Kindred spirit, Thomas Bevan, discusses how he plans NOT to retire, at least not in the traditional sense. Just like me. 😉 Full disclosure: I am a charter member of Tom's Soaring Twenties Social Club where I sometimes channel my inner bohemian. You can learn more about the STSC here.

⏰ The Roman Empire wasn't run out of offices - An interesting interview with Marc Andreessen, who reminds us that "The Roman Empire was not run out of offices. They ran the world, yet there was no office. There was no office building." The same is true for many other merchants, artisans, and bankers who, up until the 19th Century, conducted their business from homes and coffee shops in London, Amsterdam, or Zurich.

Modern offices grew out of factories and followed the same managerial logic of regimented command-and-control. They assumed (correctly, at the time) that coordinated work could not be productive unless all "components" operate under the same roof and could speak directly and hand over their documents to each other. Even when dealing with faraway colleagues and clients, employees had to be glued to their desks in case anyone called.

All these constraints are no longer valid. And since offices have been dominant for such a short time, we should not assume their continued existence is a fact of nature.

💭 Thought Bubble of the Week

Programming Note: This new addition to the Sunday Drive is intended to serve up seedling ideas which may ultimately grow into more fully developed pieces to be published on NewLanternAdvisors.com. Please share any thoughts, suggestions or feedback. I'd be most grateful.

I've been thinking about the three dimensions of risk when it comes to investing. Risk really is a three-headed dragon, and we have to deal with all three if we are to strike the right balance and avoid getting clobbered by it.

They are:

- Confidence to take risk. This is also referred to as "risk tolerance" - the emotional and psychological threshold where investors are no longer willing to bear losses in market drawdowns. The risk tolerance question is often where advisors leave off with their clients, and in my opinion, falls short of fully serving their best interests.

- Capacity to take risk. This is largely a stage of life-cycle issue. Early on in an investor's savings cycle, they do have the capacity to take more risk as they have time to recover from market declines. Indeed, dollar-cost averaging into those drawdowns as they are saving and investing during the accumulation phase of their lives can be very beneficial to their ultimate investing outcomes. On the other hand, during the few years prior to and after their retirement, it is simply not prudent for folks to take significant risks in their portfolios. Managing through the sequence of returns risk during this time is critical, and the margin for error quite slim.

- Compensation for taking risk. This question is the age-old risk vs. reward conundrum. Are valuations of various asset classes, industry sectors, and/or individual securities sufficiently attractive to warrant investment in them? Do they offer expected returns commensurate with the risks associated with making those investments? After more then three decades in the investment management business, I will say that, although in the veeeerrrrrry long term, markets may be efficient, investors often leave significant investment opportunities on the table if they blindly follow a passive approach and don't take advantage of those opportunities when they present themselves. This current volatile market environment proves the point most resoundingly.

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em at me.

I hope you have a relaxing Father's Day weekend and a great week ahead. See you next Sunday...

-Mike

Join the other geniuses who are reading this newsletter.